Renting may have its benefits, but nothing compares to the satisfaction of owning your own home. Now more than ever, it’s easy to purchase property while saying farewell to tenancy-life and hello to ownership. It’s time for American families to stop wasting money paying other people’s mortgages as tenants, and start paying off their own as owners.

Paying Your Own Mortgage Instead of Someone Else’s

No one has to be limited to renting. Anyone with a modest income or better, can own real property. Unfortunately, Americans are oblivious to this fact. Only 63% of Americans own their own home while the rest rent or live with others. There’s several factors that possibly contribute to that statistic, however, the number one reason is not lack of funds or credit status as one would assume. It’s actually lack of knowledge. Once one is educated properly on the topic of real estate transaction, then any possible hindrance can be corrected.

Not only is it possible to have your own property as a home, but later one can even purchase additional property for the purpose of subsidizing income and planning for retirement. But that’s an entirely different article in itself, so wait for it!

Home Buying 101

For starters take everything you believe to be true about qualifying for loans and wipe it from your memory. When it comes to qualifying for a home loan, credit and income are always key factors. However, that’s not to say that less than perfect income and credit will hinder your chances in acquiring the American dream.

Getting Your Credit Right

It’s not as easy to correct existing credit issues as it was to create the credit issues to begin with. According to finance professionals, one should begin repairing credit a year before attempting to purchase a home. There are several agencies within reach who can assist in repairing credit problems. You can just as easily correct your credit problems yourself using various tools on the internet and through credit bureaus.

Review Your Credit Report

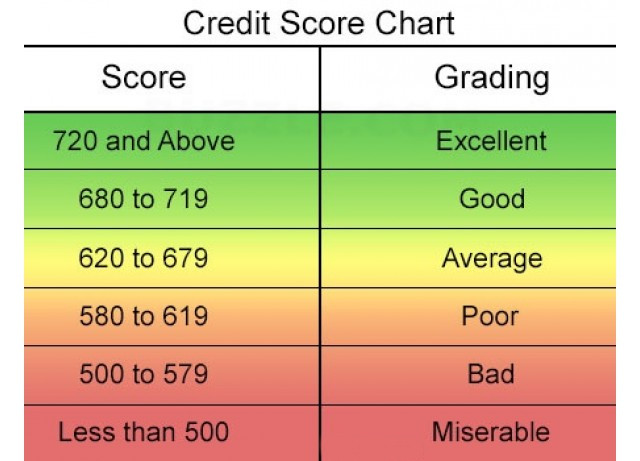

Start with obtaining your credit report and disputing outdated or false accounts. As with accurate credit marks, begin to make payment arrangements with each and every account until paid off. Before you begin this process make sure you are aware of the loan requirements regarding credit scores. For instance, a FHA loan requires a score of just 620 from all three bureaus. This is called a ‘median’ score and it will determine the ease of your loan process. If you do not want to deal with credit repair, try contacting a reputable credit repair agency.

What If You Have No Credit?

If your problem is not poor credit but rather no credit, then purchase at lease two secured credit cards to aid in improving your score. This will establish your credit. A secured credit card is one which allows you to spend your own funds while contributing to your credit score. You pay the money back just as your would a typical credit card. However, it’s nearly impossible to be denied for one, because it’s your own money, otherwise, just apply for a small credit line and refrain from neglecting it.

Reach Out and Learn

Truthfully, credit repair is the most tedious process of home ownership. It’s recommended to speak to a lender or work with an agent who is willing to walk you through the process and get you into home ownership. Later, in part two of this article, we will explain the average requirement for home loans. It’s not as bad as you may think. Home ownership may literally be just around your neighborhood corner.

I would love to know more email me are something thanks